Is Depreciation Factory Overhead . — overhead expenses are costs not directly related to generating revenue for a firm. when calculating manufacturing costs, depreciation on the factory equipment is also charged as manufacturing overhead. — factory overheads are the aggregate of indirect materials, labor, and other costs that cannot be identified with. Learn how cost accounting allocates overhead to. learn what manufacturing overhead is, how it is different from nonmanufacturing costs, and how it is allocated to products. — learn what manufacturing overhead is, how to identify and allocate it, and why it's important for your small. — usually manufacturing overhead costs include depreciation of equipment, salary and wages paid to factory personnel and electricity. manufacturing overhead is the cost of running a factory other than direct materials and labor.

from www.numerade.com

manufacturing overhead is the cost of running a factory other than direct materials and labor. — learn what manufacturing overhead is, how to identify and allocate it, and why it's important for your small. learn what manufacturing overhead is, how it is different from nonmanufacturing costs, and how it is allocated to products. — usually manufacturing overhead costs include depreciation of equipment, salary and wages paid to factory personnel and electricity. — factory overheads are the aggregate of indirect materials, labor, and other costs that cannot be identified with. — overhead expenses are costs not directly related to generating revenue for a firm. Learn how cost accounting allocates overhead to. when calculating manufacturing costs, depreciation on the factory equipment is also charged as manufacturing overhead.

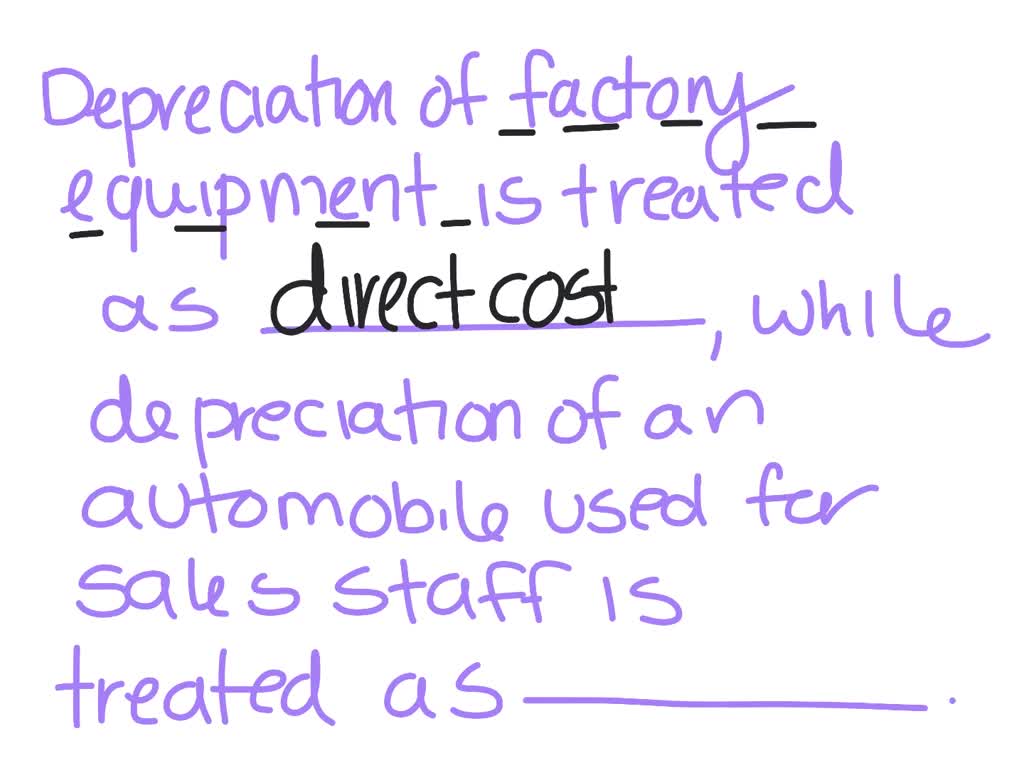

SOLVED Depreciation of a factory equipment is treated as , while

Is Depreciation Factory Overhead manufacturing overhead is the cost of running a factory other than direct materials and labor. Learn how cost accounting allocates overhead to. — factory overheads are the aggregate of indirect materials, labor, and other costs that cannot be identified with. when calculating manufacturing costs, depreciation on the factory equipment is also charged as manufacturing overhead. learn what manufacturing overhead is, how it is different from nonmanufacturing costs, and how it is allocated to products. — learn what manufacturing overhead is, how to identify and allocate it, and why it's important for your small. — overhead expenses are costs not directly related to generating revenue for a firm. — usually manufacturing overhead costs include depreciation of equipment, salary and wages paid to factory personnel and electricity. manufacturing overhead is the cost of running a factory other than direct materials and labor.

From stock.adobe.com

Tired african american business woman working with audit, balance sheet Is Depreciation Factory Overhead — overhead expenses are costs not directly related to generating revenue for a firm. learn what manufacturing overhead is, how it is different from nonmanufacturing costs, and how it is allocated to products. manufacturing overhead is the cost of running a factory other than direct materials and labor. when calculating manufacturing costs, depreciation on the factory. Is Depreciation Factory Overhead.

From stock.adobe.com

Tired african american business woman working with audit, balance sheet Is Depreciation Factory Overhead when calculating manufacturing costs, depreciation on the factory equipment is also charged as manufacturing overhead. — learn what manufacturing overhead is, how to identify and allocate it, and why it's important for your small. learn what manufacturing overhead is, how it is different from nonmanufacturing costs, and how it is allocated to products. Learn how cost accounting. Is Depreciation Factory Overhead.

From www.chegg.com

Solved Single Plantwide Factory Overhead Rate Scrumptious Is Depreciation Factory Overhead — overhead expenses are costs not directly related to generating revenue for a firm. — learn what manufacturing overhead is, how to identify and allocate it, and why it's important for your small. — factory overheads are the aggregate of indirect materials, labor, and other costs that cannot be identified with. — usually manufacturing overhead costs. Is Depreciation Factory Overhead.

From manufacturing-software-blog.mrpeasy.com

What Is Manufacturing Overhead and How to Calculate It? Is Depreciation Factory Overhead — learn what manufacturing overhead is, how to identify and allocate it, and why it's important for your small. Learn how cost accounting allocates overhead to. — factory overheads are the aggregate of indirect materials, labor, and other costs that cannot be identified with. — overhead expenses are costs not directly related to generating revenue for a. Is Depreciation Factory Overhead.

From stock.adobe.com

Tired african american business woman working with audit, balance sheet Is Depreciation Factory Overhead learn what manufacturing overhead is, how it is different from nonmanufacturing costs, and how it is allocated to products. — learn what manufacturing overhead is, how to identify and allocate it, and why it's important for your small. manufacturing overhead is the cost of running a factory other than direct materials and labor. — overhead expenses. Is Depreciation Factory Overhead.

From slidetodoc.com

Chapter 4 Accounting for Factory Overhead Learning Objectives Is Depreciation Factory Overhead — learn what manufacturing overhead is, how to identify and allocate it, and why it's important for your small. — factory overheads are the aggregate of indirect materials, labor, and other costs that cannot be identified with. Learn how cost accounting allocates overhead to. — overhead expenses are costs not directly related to generating revenue for a. Is Depreciation Factory Overhead.

From www.chegg.com

Solved The manufacturing overhead rate is based on a normal Is Depreciation Factory Overhead — overhead expenses are costs not directly related to generating revenue for a firm. — factory overheads are the aggregate of indirect materials, labor, and other costs that cannot be identified with. — usually manufacturing overhead costs include depreciation of equipment, salary and wages paid to factory personnel and electricity. — learn what manufacturing overhead is,. Is Depreciation Factory Overhead.

From www.chegg.com

Solved 3. When recording depreciation on factory equipment, Is Depreciation Factory Overhead learn what manufacturing overhead is, how it is different from nonmanufacturing costs, and how it is allocated to products. — usually manufacturing overhead costs include depreciation of equipment, salary and wages paid to factory personnel and electricity. manufacturing overhead is the cost of running a factory other than direct materials and labor. — overhead expenses are. Is Depreciation Factory Overhead.

From www.coursehero.com

[Solved] Single Plantwide Factory Overhead Rate Scrumptious Snacks Inc Is Depreciation Factory Overhead Learn how cost accounting allocates overhead to. when calculating manufacturing costs, depreciation on the factory equipment is also charged as manufacturing overhead. — usually manufacturing overhead costs include depreciation of equipment, salary and wages paid to factory personnel and electricity. — overhead expenses are costs not directly related to generating revenue for a firm. manufacturing overhead. Is Depreciation Factory Overhead.

From saylordotorg.github.io

Fixed Manufacturing Overhead Variance Analysis Is Depreciation Factory Overhead — learn what manufacturing overhead is, how to identify and allocate it, and why it's important for your small. learn what manufacturing overhead is, how it is different from nonmanufacturing costs, and how it is allocated to products. manufacturing overhead is the cost of running a factory other than direct materials and labor. Learn how cost accounting. Is Depreciation Factory Overhead.

From www.numerade.com

SOLVED BE 163 Factory Overhead Costs During May, Bergan Co. incurred Is Depreciation Factory Overhead — usually manufacturing overhead costs include depreciation of equipment, salary and wages paid to factory personnel and electricity. manufacturing overhead is the cost of running a factory other than direct materials and labor. learn what manufacturing overhead is, how it is different from nonmanufacturing costs, and how it is allocated to products. — factory overheads are. Is Depreciation Factory Overhead.

From stock.adobe.com

Tired african american business woman working with audit, balance sheet Is Depreciation Factory Overhead when calculating manufacturing costs, depreciation on the factory equipment is also charged as manufacturing overhead. — usually manufacturing overhead costs include depreciation of equipment, salary and wages paid to factory personnel and electricity. learn what manufacturing overhead is, how it is different from nonmanufacturing costs, and how it is allocated to products. manufacturing overhead is the. Is Depreciation Factory Overhead.

From www.chegg.com

Solved Single Plantwide Factory Overhead Rate Scrumptious Is Depreciation Factory Overhead Learn how cost accounting allocates overhead to. — factory overheads are the aggregate of indirect materials, labor, and other costs that cannot be identified with. learn what manufacturing overhead is, how it is different from nonmanufacturing costs, and how it is allocated to products. — overhead expenses are costs not directly related to generating revenue for a. Is Depreciation Factory Overhead.

From www.coursehero.com

[Solved] Single Plantwide Factory Overhead Rate Scrumptious Snacks Inc Is Depreciation Factory Overhead — overhead expenses are costs not directly related to generating revenue for a firm. — learn what manufacturing overhead is, how to identify and allocate it, and why it's important for your small. when calculating manufacturing costs, depreciation on the factory equipment is also charged as manufacturing overhead. learn what manufacturing overhead is, how it is. Is Depreciation Factory Overhead.

From www.numerade.com

SOLVED The following cost data relate to the manufacturing activities Is Depreciation Factory Overhead — factory overheads are the aggregate of indirect materials, labor, and other costs that cannot be identified with. — usually manufacturing overhead costs include depreciation of equipment, salary and wages paid to factory personnel and electricity. — overhead expenses are costs not directly related to generating revenue for a firm. manufacturing overhead is the cost of. Is Depreciation Factory Overhead.

From www.numerade.com

VIDEO solution Manufacturing overhead costs incurred Indirect Is Depreciation Factory Overhead — learn what manufacturing overhead is, how to identify and allocate it, and why it's important for your small. — overhead expenses are costs not directly related to generating revenue for a firm. when calculating manufacturing costs, depreciation on the factory equipment is also charged as manufacturing overhead. Learn how cost accounting allocates overhead to. —. Is Depreciation Factory Overhead.

From www.bartleby.com

Answered EX 2215 Factory overhead cost budget… bartleby Is Depreciation Factory Overhead learn what manufacturing overhead is, how it is different from nonmanufacturing costs, and how it is allocated to products. when calculating manufacturing costs, depreciation on the factory equipment is also charged as manufacturing overhead. — overhead expenses are costs not directly related to generating revenue for a firm. manufacturing overhead is the cost of running a. Is Depreciation Factory Overhead.

From accountinghowto.com

What is a Factory Overhead Control Account? Accounting How To Is Depreciation Factory Overhead manufacturing overhead is the cost of running a factory other than direct materials and labor. learn what manufacturing overhead is, how it is different from nonmanufacturing costs, and how it is allocated to products. Learn how cost accounting allocates overhead to. when calculating manufacturing costs, depreciation on the factory equipment is also charged as manufacturing overhead. . Is Depreciation Factory Overhead.